AI赋能金融:量化交易新革命

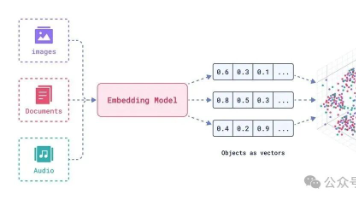

金融大数据的来源包括市场行情数据、基本面数据、新闻舆情数据和社交媒体数据等。人工智能技术与金融大数据的结合为量化交易带来了革命性的变化。通过机器学习、深度学习和自然语言处理等技术,人工智能能够从海量金融数据中提取有价值的信息,构建高效的交易策略。通过上述技术和方法,人工智能能够从金融大数据中挖掘出有价值的交易信号,构建稳健的量化交易策略。人工智能在量化交易中的应用将继续深化,主要趋势包括:多模态数

人工智能在金融大数据量化交易中的应用

人工智能技术与金融大数据的结合为量化交易带来了革命性的变化。通过机器学习、深度学习和自然语言处理等技术,人工智能能够从海量金融数据中提取有价值的信息,构建高效的交易策略。

数据获取与预处理

金融大数据的来源包括市场行情数据、基本面数据、新闻舆情数据和社交媒体数据等。这些数据通常具有高维度、非结构化和噪声大的特点,需要进行清洗和预处理。Python的Pandas库是处理金融数据的利器。

import pandas as pd

import numpy as np

# 加载股票数据

data = pd.read_csv('stock_data.csv', parse_dates=['date'], index_col='date')

# 处理缺失值

data = data.fillna(method='ffill')

# 计算对数收益率

data['log_return'] = np.log(data['close']/data['close'].shift(1))

# 标准化数据

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

scaled_features = scaler.fit_transform(data[['open', 'high', 'low', 'volume']])

特征工程

有效的特征工程能显著提升模型性能。技术指标、统计特征和波动率特征等都是常用的量化特征。

# 计算技术指标

def calculate_technical_indicators(df):

# 移动平均

df['ma5'] = df['close'].rolling(window=5).mean()

df['ma20'] = df['close'].rolling(window=20).mean()

# 相对强弱指数(RSI)

delta = df['close'].diff()

gain = (delta.where(delta > 0, 0)).rolling(window=14).mean()

loss = (-delta.where(delta < 0, 0)).rolling(window=14).mean()

rs = gain / loss

df['rsi'] = 100 - (100 / (1 + rs))

# 布林带

df['upper_band'] = df['ma20'] + 2*df['close'].rolling(window=20).std()

df['lower_band'] = df['ma20'] - 2*df['close'].rolling(window=20).std()

return df

data = calculate_technical_indicators(data)

机器学习模型构建

监督学习算法如随机森林、梯度提升树和深度学习模型在量化交易中广泛应用。模型的目标通常是预测未来价格变动方向或幅度。

from sklearn.model_selection import train_test_split

from sklearn.ensemble import RandomForestClassifier

from sklearn.metrics import classification_report

# 创建标签 - 未来5天收益率是否为正

data['target'] = (data['close'].shift(-5) > data['close']).astype(int)

# 移除包含NaN的行

data = data.dropna()

# 划分训练集和测试集

X = data.drop(['target', 'close'], axis=1)

y = data['target']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, shuffle=False)

# 训练随机森林模型

model = RandomForestClassifier(n_estimators=100, random_state=42)

model.fit(X_train, y_train)

# 评估模型

y_pred = model.predict(X_test)

print(classification_report(y_test, y_pred))

深度学习模型应用

深度学习模型如LSTM能够捕捉金融时间序列中的非线性关系和长期依赖。

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import LSTM, Dense, Dropout

from tensorflow.keras.optimizers import Adam

# 准备LSTM输入数据

def create_dataset(dataset, look_back=60):

X, y = [], []

for i in range(len(dataset)-look_back-1):

a = dataset[i:(i+look_back), :]

X.append(a)

y.append(dataset[i + look_back, -1])

return np.array(X), np.array(y)

look_back = 60

X, y = create_dataset(scaled_features, look_back)

# 划分训练测试集

train_size = int(len(X) * 0.8)

X_train, X_test = X[:train_size], X[train_size:]

y_train, y_test = y[:train_size], y[train_size:]

# 构建LSTM模型

model = Sequential()

model.add(LSTM(50, return_sequences=True, input_shape=(look_back, X_train.shape[2])))

model.add(Dropout(0.2))

model.add(LSTM(50))

model.add(Dropout(0.2))

model.add(Dense(1, activation='sigmoid'))

model.compile(optimizer=Adam(learning_rate=0.001),

loss='binary_crossentropy',

metrics=['accuracy'])

# 训练模型

history = model.fit(X_train, y_train,

epochs=50,

batch_size=32,

validation_data=(X_test, y_test),

verbose=1)

强化学习在交易策略中的应用

强化学习通过模拟交易环境,让智能体学习最优交易策略。深度Q网络(DQN)是常用的方法之一。

import gym

from gym import spaces

import numpy as np

class TradingEnv(gym.Env):

def __init__(self, data, initial_balance=10000):

super(TradingEnv, self).__init__()

self.data = data

self.initial_balance = initial_balance

self.current_step = 0

# 动作空间: 0=持有, 1=买入, 2=卖出

self.action_space = spaces.Discrete(3)

# 观察空间: 市场数据+账户状态

self.observation_space = spaces.Box(low=-np.inf, high=np.inf, shape=(data.shape[1]+2,))

def reset(self):

self.balance = self.initial_balance

self.shares_held = 0

self.current_step = 0

return self._next_observation()

def _next_observation(self):

obs = np.append(self.data.iloc[self.current_step].values,

[self.balance, self.shares_held])

return obs

def step(self, action):

current_price = self.data.iloc[self.current_step]['close']

if action == 1: # 买入

shares_bought = self.balance // current_price

cost = shares_bought * current_price

self.balance -= cost

self.shares_held += shares_bought

elif action == 2: # 卖出

reward = self.shares_held * current_price

self.balance += reward

self.shares_held = 0

# 计算收益

reward = self.balance + self.shares_held * current_price - self.initial_balance

# 移动到下一步

self.current_step += 1

done = self.current_step >= len(self.data) - 1

return self._next_observation(), reward, done, {}

风险管理与组合优化

有效的风险控制是量化交易成功的关键。现代投资组合理论(MPT)和风险平价策略是常用的方法。

import cvxpy as cp

# 投资组合优化

def optimize_portfolio(expected_returns, cov_matrix, risk_aversion=0.5):

n = len(expected_returns)

weights = cp.Variable(n)

# 定义目标函数

portfolio_return = expected_returns.T @ weights

portfolio_risk = cp.quad_form(weights, cov_matrix)

objective = cp.Maximize(portfolio_return - risk_aversion * portfolio_risk)

# 添加约束条件

constraints = [cp.sum(weights) == 1, weights >= 0]

# 解决问题

problem = cp.Problem(objective, constraints)

problem.solve()

return weights.value

# 计算预期收益率和协方差矩阵

returns = data.pct_change().dropna()

expected_returns = returns.mean().values

cov_matrix = returns.cov().values

# 优化投资组合

optimal_weights = optimize_portfolio(expected_returns, cov_matrix)

print("Optimal Weights:", optimal_weights)

回测与策略评估

策略开发后需要进行严格的历史回测,评估其表现和稳健性。

import backtrader as bt

class MLStrategy(bt.Strategy):

params = (

('lookback', 60),

)

def __init__(self):

self.dataclose = self.datas[0].close

self.model = load_model() # 加载预训练模型

def next(self):

if len(self) < self.params.lookback:

return

# 准备输入数据

recent_data = np.array([self.datas[0].close.get(size=self.params.lookback)])

recent_data = scaler.transform(recent_data)

# 预测

prediction = self.model.predict(recent_data)

# 执行交易

if prediction > 0.7 and not self.position:

self.buy(size=100)

elif prediction < 0.3 and self.position:

self.close()

# 创建回测引擎

cerebro = bt.Cerebro()

data = bt.feeds.PandasData(dataname=data)

cerebro.adddata(data)

cerebro.addstrategy(MLStrategy)

cerebro.broker.setcash(100000.0)

# 运行回测

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.run()

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

# 绘制结果

cerebro.plot()

实时交易系统架构

生产环境的量化交易系统需要低延迟、高可靠性的架构设计。

数据采集层 -> 数据处理层 -> 模型预测层 -> 交易执行层 -> 风险监控层

未来发展趋势

人工智能在量化交易中的应用将继续深化,主要趋势包括:多模态数据融合、元学习技术的应用、可解释AI在金融领域的推广,以及量子计算与AI的结合等。

通过上述技术和方法,人工智能能够从金融大数据中挖掘出有价值的交易信号,构建稳健的量化交易策略。然而,实际应用中仍需注意市场变化、模型过拟合和交易成本等因素的影响。

更多推荐

已为社区贡献10条内容

已为社区贡献10条内容

所有评论(0)